Looking to modernize your CPA practice? The current tax environment has evolved far beyond calculators and paper forms. Modern accounting demands sophisticated platforms that can handle everything from automated workflows to secure client communications.

With complex tax legislation, cutting-edge professional tax software has become essential for practice success. A single oversight can spiral into hours of revisions and potential liability issues, which means selecting the right platform determines a practice’s competitiveness.

This article explores top tax practice management solutions, examining workflow automation, integration capabilities, and cloud-based security features that define today’s leading accounting software options.

Table of Contents

- What is tax practice management software?

- How to select the best tax practice management software/a>

- Selecting the ideal tax software for your practice

- Karbon – Best for workflow automation

- Canopy – Best for client communication & billing

- SafeSend – Best for automating the tax return delivery process

- Harness – Best for high-net-worth tax advisory support

- Ignition – Best for engagement letters & billing automation

- TaxDome – All-in-one practice management solution

- Financial Cents – Best for growing firms focused on scaling

- What is the best tax practice management software for your firm?

Key takeaways:

- Tax practice management software combines technology, processes, and client communications to help tax advisors manage and grow their practice more effectively.

- Common features of tax practice management software include engagement management, document management and e-signatures, billing and invoices, and client portals.

- Some tax practice management software providers are creating additional value for advisors by offering introductions to new clients and integrated client success

- Seven modern practice management software providers for breakaway tax advisors and small firms are Karbon, Canopy, TaxDome, Harness, SafeSend, Ignition, and Financial Cents.

- Tax practices should consider software providers that offer new client acquisition services, client onboarding and renewal support, time-saving technology, and access to professional development opportunities.

What is tax practice management software?

Tax practice management software brings together technology, processes, client communications, and automated task reminders to help tax professionals manage and grow their practice more effectively.

This software typically includes features such as automated task reminders, document management, client portals, and workflow automation, all of which contribute to more efficient practice management.

By centralizing these functions, tax professionals can focus on providing quality service and growing their practice, while reducing administrative burdens and minimizing errors.

How to select the best tax practice management software

When it comes to tax software solutions, form coverage is where the rubber meets the road. First, you need to think about your firm’s needs—from acquiring to retaining clients—which creates a solid foundation for your future.

For example, your practice’s efficiency lives or dies by how well your software streamlines repetitive tasks. Based on our research, the best modern solutions offer both prior-year data importing and seamless integration with various financial platforms. Given this, we recommend looking for systems that can process similar returns in batches, and incorporate electronic signatures to eliminate the paper chase once and for all.

Ultimately, the best tax practice management platforms deliver on the following five goals to support your firm’s success:

- Acquiring and onboarding new clients

- Coordinate client management and experience

- Streamline operations with technology and software integrations

- Leverage a community of advisors for support

- Cloud-based solutions so you can

As you compare practice management software, evaluate the following technology areas:

- The provider’s tax software or third-party integrations, which are used to manage your tax process, from data collection to e-filing.

- The platform’s business process technologies, which are used to streamline operations, including document management and scanning, e-signature capabilities, bulk task management, automated client status updates, and client task reminders.

In the next sections, we’ll break down the top seven best tax practice management software solutions to help you make an informed decision.

How to select the best tax practice management software

The reality of the current tax environment shows a significant difference between basic tax software and comprehensive practice management tools. Why? Because modern CPA firms require robust filing capabilities alongside platforms that can orchestrate their entire practice.

Whether you are looking to enhance client experience through TaxDome, Canopy, or streamline workflows with Karbon, Financial Cents, or target high-net-worth clients via Harness, the right software choice can revolutionize your practice’s efficiency.

However, being strategic about the selection process is key. Your chosen platform needs to align perfectly with your firm’s unique DNA—its size, client complexity, workflow preferences, and growth trajectory. Don’t get caught up in feature lists or popular opinion–focus on finding software that complements your specific practice needs and enhances your team’s natural workflows.

When you make the right choice, your tax practice management software evolves into a cornerstone of your success.

1. Karbon – Best for workflow automation

Looking for a practice management powerhouse? Meet Karbon.

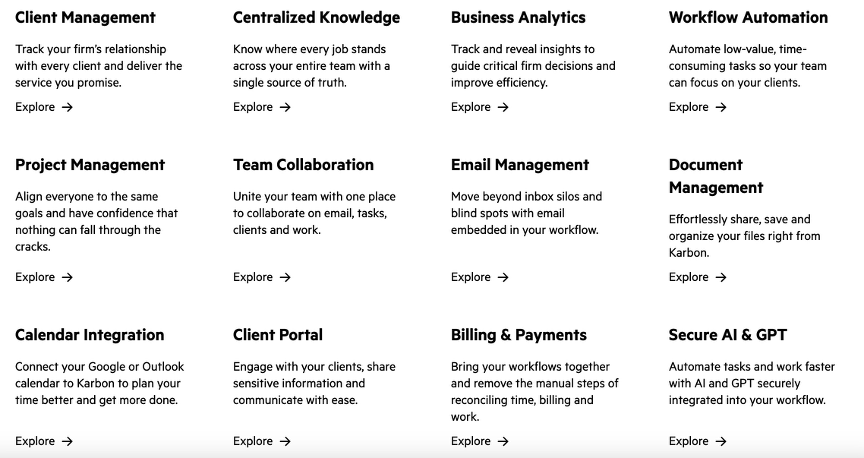

Karbon’s visual dashboards turn complex practice management into something you can actually wrap your head around, letting you spot bottlenecks and track progress at a glance. Even during the craziest tax seasons, the platform’s sophisticated email integration ensures no client communication slips through the cracks.

For tedious administrative tasks, Karbon really flexes its automation muscles. We’re not talking about essential task management here—this platform creates smart workflows that adapt to your firm’s unique needs. From bringing new clients on board to handling recurring compliance work, Karbon reduces manual intervention while keeping your service standards high.

Growing pains? Karbon has your back. The software scales alongside your practice, with robust automation tools that eliminate many typical expansion headaches. To free you up for what really matters, Karbon streamlines those administrative processes, allowing you to focus on delivering expert tax and advisory services to your clients.

2. Canopy – Best for client communication & billing

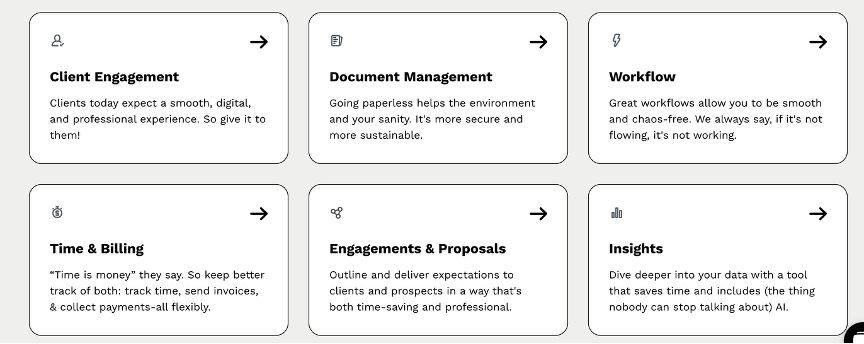

Want to take your client relationships to the next level? That is where Canopy comes in. Your “firm-wide operating system,” Canopy‘s accounting tax practice management software is made for teams that want to maximize their time.

Its secure client portal combines document sharing functionality with bank-level security to build trust. This commitment to secure communication creates the foundation you need for lasting client relationships.

Canopy streamlines everything from engagement letters to billing, but what really sets it apart is how all these features work together. Every component works together to reduce administrative overhead and boost client satisfaction, creating a seamless practice management experience beyond individual features.

If you’re tired of chasing down clients for signatures or payments, Canopy’s automation capabilities could be your best bet. When client communication is centralized and routine tasks are automated, you will free up time for what really matters—providing high-value advisory services.

Plus, with integrated online payments, you can say goodbye to those billing headaches for good.

3. SafeSend – Best for automating the tax return delivery process

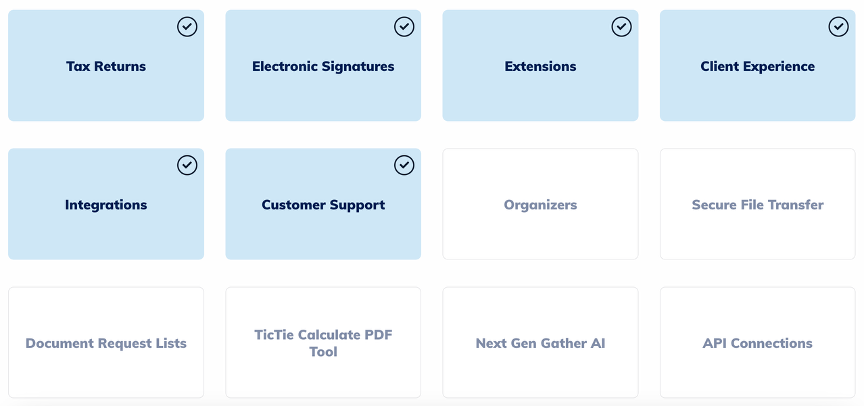

When it comes to modernizing tax return delivery, SafeSend offers transformative benefits for firms ready to ditch manual processes. Through seamless integration with industry heavyweights like UltraTax CS, CCH Axcess, and Lacerte, it creates a unified ecosystem that transforms your entire tax return workflow.

Say goodbye to typical operating bottlenecks—SafeSend turns delivery and signature collection into a smooth, client-friendly experience.

Here is what makes SafeSend truly shine: its laser focus on the significant final stages of tax preparation. The platform delivers comprehensive management of the entire review, signature, and return process with precision. If you are drowning in tax season follow-ups, SafeSend’s automation capabilities like their Automated Tax Intake could be your lifeline.

Behind SafeSend’s intuitive interface lies some serious automation muscle. When clients receive their tax returns, they experience a straightforward, professional process that reflects well on your practice. Combine that enhanced client experience with major time savings for your staff, and you have got a compelling reason to modernize your delivery workflow.

4. Harness – Best for high-net-worth tax advisory support

Harness is not your typical tax software—it is a sophisticated matchmaking platform connecting qualified tax professionals with affluent clients seeking comprehensive financial planning services. If you are looking to break free from compliance-only work and step into the lucrative advisory services market, this could be your pathway.

Harness pairs you and your firm with high-value tax clients whose needs align with your interests and areas of expertise, helping you maximize your profits without compromising the level of service you provide. This aligns perfectly with the industry’s shift toward value-based pricing and advisory services. It also features:

- High-quality, high-value client leads. Harness provides advisors with warm introductions to clients with complex tax needs who are seeking personalized tax advice for themselves and their businesses. At Harness, tax advisory service fees range anywhere from $1,200 to $10,000 or more per year.

- Relevant partnerships that create mutual opportunities for growth. Harness works with premier financial service companies that serve clients who also need tax advice on complex matters, including equity compensation, corporate interests, crypto assets, and independent businesses.

From time-saving customer support, including troubleshooting, status updates, and client billing support, you can lean on Harness Concierge for any additional support you may need in keeping your client billing up to date. If applicable, our team also handles the collection of retainer payments as well.

“I don’t have to chase clients for information anymore. The Concierge and the tech tools take the administrative work off my plate, empowering me to operate more efficiently.” – Sam Boehr, JD, LLM

For CPAs ready to move beyond routine tax preparation, we offer a clear path forward with software and services to support your firm’s growth. The result? Higher revenue per client, and more substantial retention rates as you transform from tax preparer to trusted advisor. Set up an intro with Harness today.

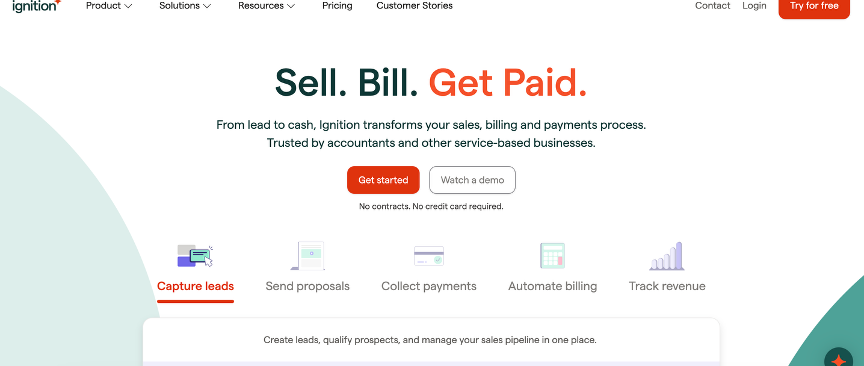

5. Ignition – Best for engagement letters & billing automation

Next in our review list is Ignition—a practice management solution that tackles one of the biggest headaches facing CPA firms head-on: client onboarding and billing. Trusted by 8000+ service-based businesses, it’s no surprise that the problem is alive and real.

It may sound simple on the surface, but when used effectively, it transforms those time-consuming administrative tasks of proposals, engagement letters, and recurring billing into smooth operations. Plus, it plays nice with platforms you are already using, like QuickBooks and Xero, so you can upgrade your client-facing processes without disrupting your existing workflow.

But here’s where Ignition really shines: payment collection. Through integration of both credit card and ACH options right into the platform, it eliminates that awkward payment follow-up dance many firms know all too well. The seamless flow from proposal to payment creates a professional experience that clients truly appreciate.

When it comes to the impact on your cash flow, if you are wrestling with irregular payment cycles or scope creep, Ignition’s automated billing and clear engagement parameters provide the structure you need. CPAs love how it helps maintain professional boundaries while keeping the cash flowing—a combination that plays a key role in building a sustainable practice.

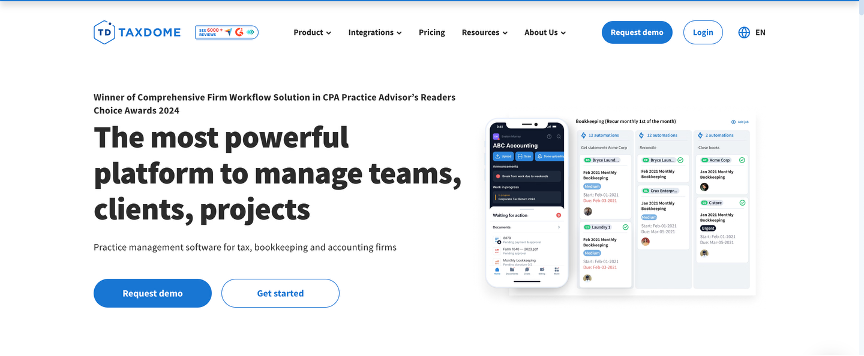

6. TaxDome – All-in-one practice management solution

Best for small to mid-sized CPA firms seeking comprehensive functionality without the hassle of multiple systems, TaxDome is transforming how firms operate.

Its secure client portal with integrated e-signature capabilities makes document handling a breeze while maintaining professional standards. Plus, the tool offers white-labeled client communications to ensure your brand stays front and center in every interaction.

But what makes TaxDome really stand out? It brings CRM, invoicing, and automated workflows together under one roof.

Tired of juggling multiple subscriptions and dealing with integration headaches? TaxDome’s unified approach could be your answer. Plus, with unlimited document storage included, you can forget about storage limits or surprise fees.

When comparing different practice management software options, TaxDome stands out by putting user experience first. Behind its intuitive interface lies some serious technological muscle, making it accessible to firms of all technical levels. Considering this, many CPAs consider TaxDome their secret weapon for practice efficiency.

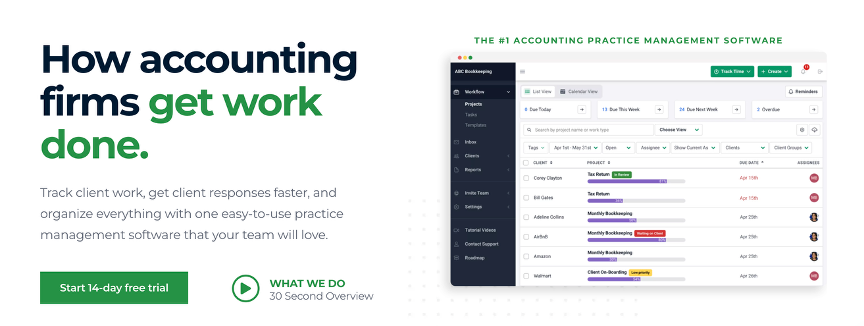

7. Financial Cents – Best for growing firms focused on scaling

Growing pains hitting your mid-sized CPA firm? Financial Cents has your back.

At its core, the platform’s customizable workflows and automation capabilities provide the structure you need to scale efficiently. To maintain quality standards while expanding your client base, the system uses smart task allocation and automated follow-ups.

But where Financial Cents shines by giving partners clear visibility into team performance and project status in growing firms. Instead of letting bottlenecks slow you down, you will have the tools to spot and solve issues before they impact client service. Plus, the intuitive design means new team members can hit the ground running—essential when you are scaling up fast.

Within the current market, Financial Cents stands out as a valuable solution for practices serious about sustainable growth. When automating routine tasks and providing clear oversight of operations, it helps you maintain high service standards while scaling up.

For ambitious practices planning their growth trajectory, this balance of efficiency and quality control is invaluable.

What is the best tax practice management software for your firm?

In summary, selecting the right tax practice management software is crucial for optimizing your financial operations and ensuring compliance. The best software not only streamlines your tax processes but also provides insightful analytics to help you make informed decisions, ultimately leading to increased efficiency and profitability.

Take action today by exploring the leading tax practice management software options available to make an informed decision.

At Harness, we’re setting a new standard for efficient practice management that fuels revenue growth and increased profitability. Whether you’re trying to create additional capacity for your firm or starting your own practice after years in the industry, we’ve built a platform to optimize your tax practice. Explore today.